Your supply chain finance solutions.

Powered.

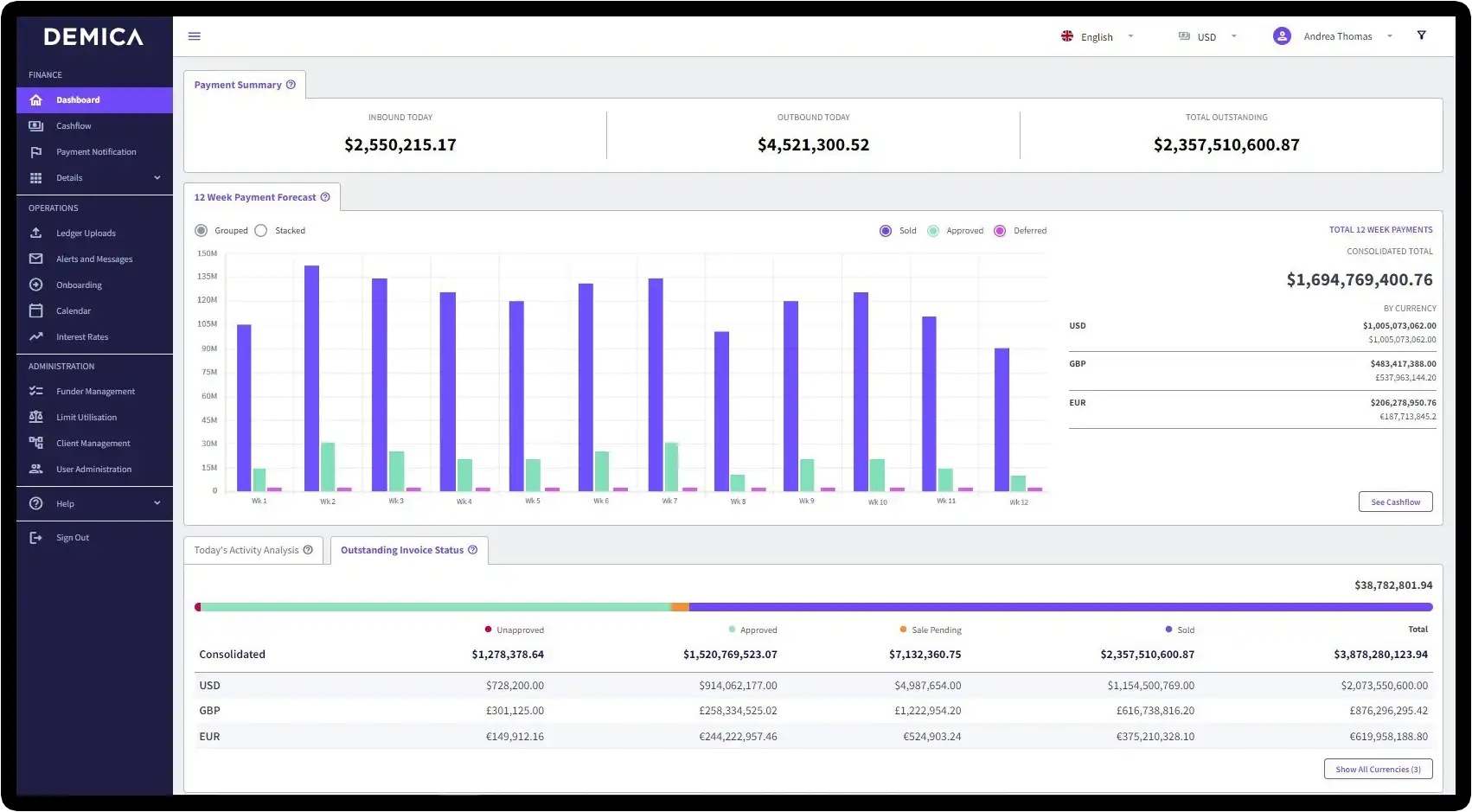

Our intuitive platform drives payables and receivables finance programmes for the world’s largest banks and corporates.

Secure a demo

Learn more

Secure a demo

Learn more

For Banks

Grow your revenues with our multi-product capability and best-in-class service.

Deliver greater efficiency. Scalable and resilient technology, with straight through processing.

Manage operational risk. Comprehensive portfolio reporting and operational controls.

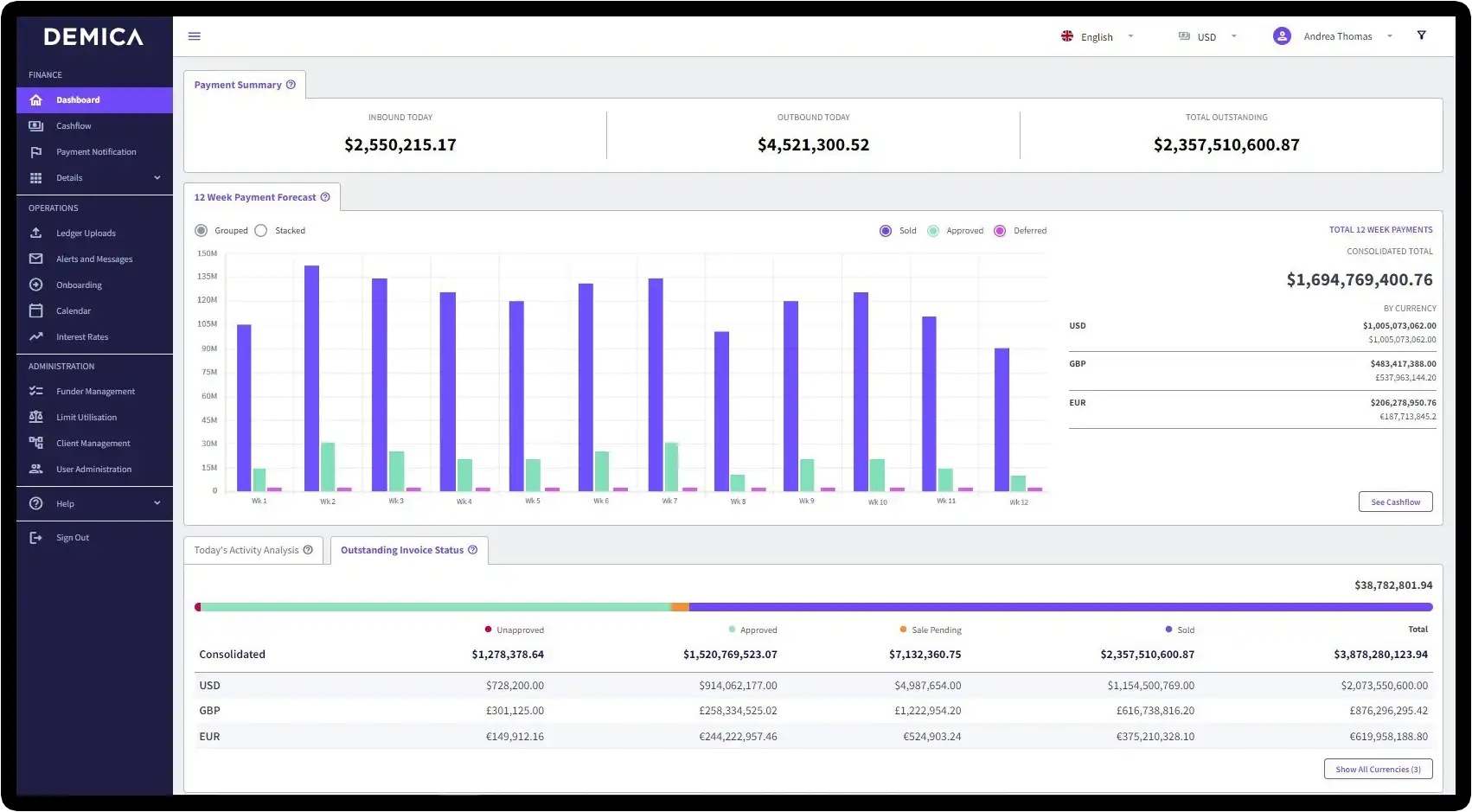

For Corporates

Unlock capital. Sell receivables to release cash and reinvest in your business.

Improve cash flow. Optimise terms with your buyers and suppliers.

Reduce risk. Replace debt with committed non-recourse, off-balance sheet structures.

Why do clients choose us?

“We’re pleased to go live on the enhanced platform, delivering an improved customer journey thanks to self-service capabilities and reporting”

VINAY MENDONCA, CHIEF GROWTH OFFICER, GTRF, HSBC

The people behind the business

We have a unique combination of financial and technology expertise, which allows us to build to our customers’ requirements and deliver best-in-class solutions. Learn about the people driving Demica forward.